So I've learned early on that you can use your ROTH IRA as a tax free way for retirement.

But, I recently found out that you can trade within a ROTH IRA.

Also found out you can open up unlimited ROTH IRA's but must only contribute max $7,000 total. Meaning you can't just add $7k in three ROTHS.

Anyways, what I decided to do is simple (in my eyes) which is to buy low and sell high...

I know you cannot time the markets lowest points or highest points, that is not my goal.

Instead I will buy what I can afford then sell for a profit (i have to figure out a percentage I am willing to sell.)

Since 2022 I've been placing $6k into my ROTH and just investing into stocks and holding long term.

The obvious I noticed is that the longer you hold, the greater the return...

Only downside is time, we have limited amounts of it.

Therefore, in my situation being 26years old of the time typing this out...

I don't look at a ROTH like the end all be all...

Instead, I'm looking at it as a chance to grow it as big as I can before I retire...

If I some how fail to so do, at least I can say I tried lol.

Max I can add is $7K anyways, it's not like I can blow my entire life savings on this method of mine...

I am not day trading or option trading in this specific account.

Swing trading is the method I'll be doing.

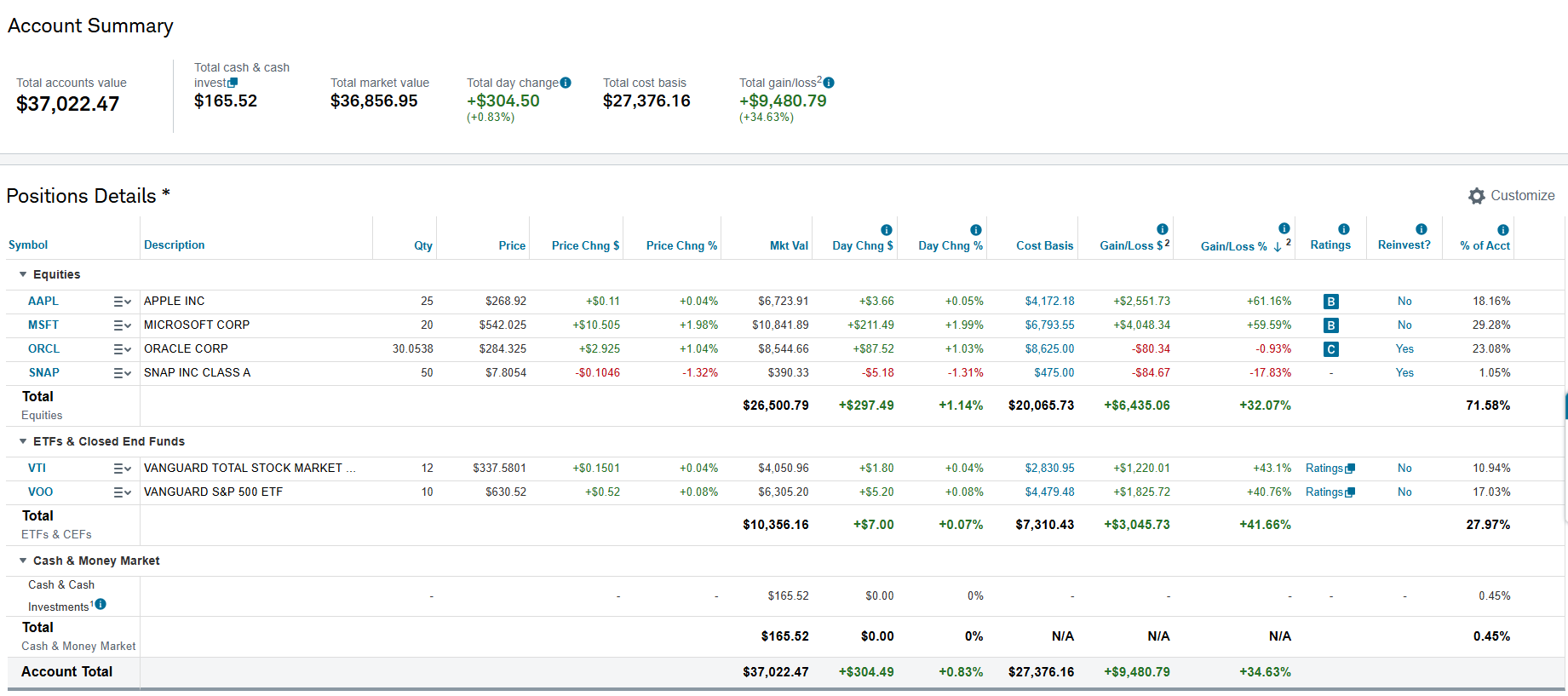

These are the current stocks & amount of shares I have in my ROTH IRA:

I'll be posting all the stocks I buy and sell within this account.

How long will it take me to get to 1-million?

I have no clue, I'm only 26 years old...enjoying the process of learning as I make mistakes is really why I am doing this, the number is just to see the finish line in the distance.

But If I'm being honest, as long as I get there before retirements haha because to me that is an accomplishment of mine that I've set out to do.