So at this point, the account is sitting at $3,110.01.

And once again — I still didn’t fully know what I was doing.

BUT

This time… I was at least trying to learn.

TJX (aka TJ Maxx / Marshalls / HomeGoods) looked like a solid company from a fundamentals standpoint:

- Consistent demand

- Recession-friendly business model

- Strong brand ecosystem

So I made the trade on my own — no guidance, no “buy this now” group chat, no influence from anybody.

This Is Where I Got Serious

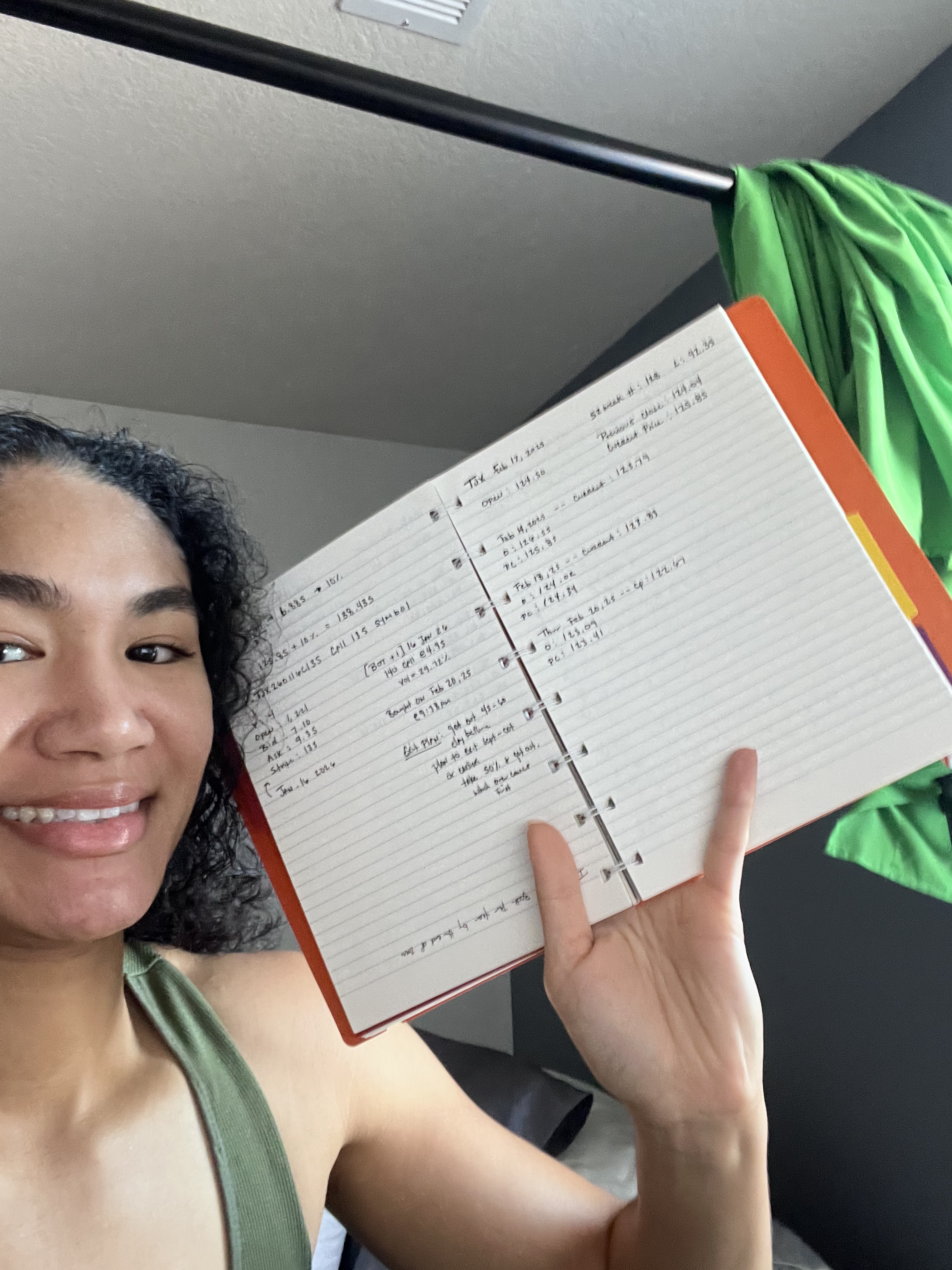

I even bought a trading journal — like a real one — and started recording:

- Contract cost at entry

- What price the stock pulled back to

- What discount the contract came back to

Basically, I was finally treating trading like an actual skill, not a guessing game.

And honestly — things were going great.

The trade was moving my way.

Confidence was high.

I was like:

“Oh wow… maybe all I needed was research!”

Then Something Happened For Everything To Go Downhill:

Trump announced tariff adjustments.

Elon mentions a $5,000 EV tax credit.

Target gets swept into political controversy.

Healthcare headlines start flying.

Basically, macro chaos entered the chat.

Volatility kicked in fast.

So I sold the TJX call.

Lesson #1:

Macro news doesn’t care how good your research is.

It can disrupt an otherwise perfect setup.

But Wait… I Did the Most Human Thing Ever 🤦🏽♀️

I looked at TJX after the dip and thought:

“Oh, it’s cheaper now…

So obviously the universe wants me to buy it again.”

So yes.

I re-entered.

Emotion took the wheel.

And now I’m sitting at $3,105.68 in cash after that second entry.

FINALLY PROFITED.

Like real, actual, green profit.

Not “break-even but I’m calling it a win to save dignity” profit.

I was SO happy.

This was the moment that made it click:

“Oh… so this is what it feels like when a trade goes well in your favor

BUT… Plot Twist. I Wasn’t Actually in the Green 😭

So here’s where reality hits like a poorly timed text message:

I thought I profited.

I felt like I profited.

I celebrated like I profited…

I did not profit.

What actually happened was something called a wash sale.

If you're new to that term, here’s the simple explanation:

A wash sale happens when you sell a position at a loss, and then buy back the same stock or options contract within 30 days.

When you do that, the IRS basically pops in like:

“No ma’am. That loss? Yeah… we’re gonna need you to hold that until later.”

— Sincerely, The Government

Meaning your loss doesn’t count yet…

Which also means your “profit” may just be your previous loss being recycled.

Let’s break down exactly what happened with my TJX contract:

Same Contract Every Time

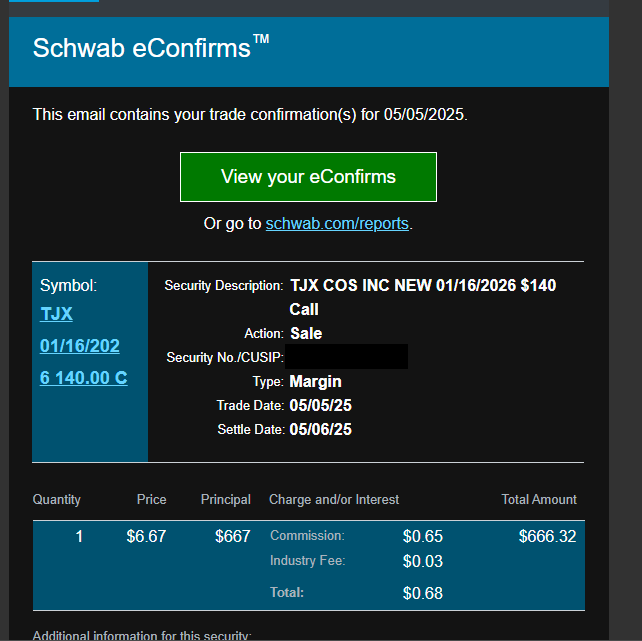

Expiration: 01/16/2026

Strike Price: $140

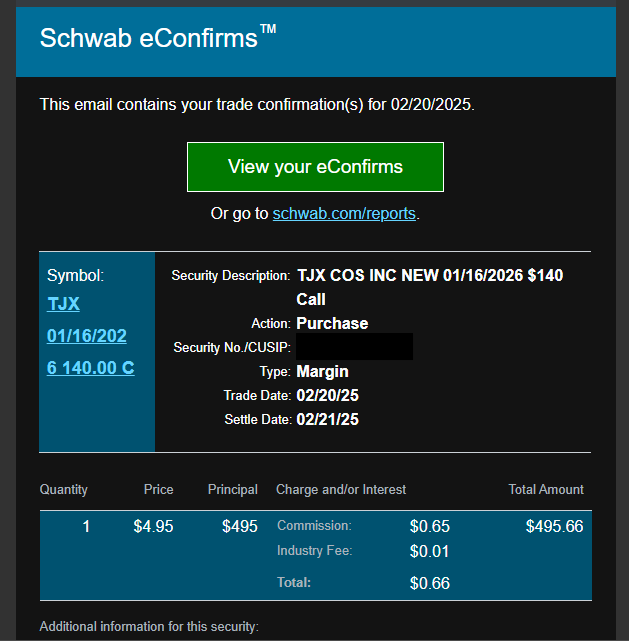

First Round

Bought: $495.66

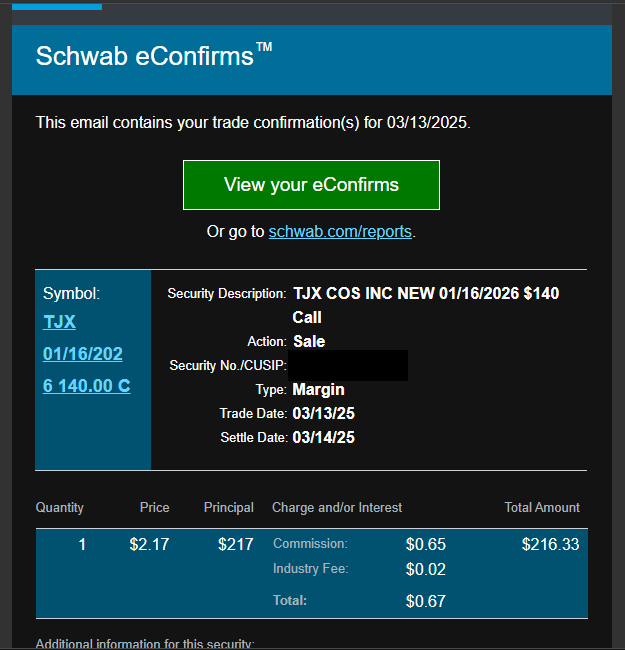

Sold: $216.33

Loss: -$279.33

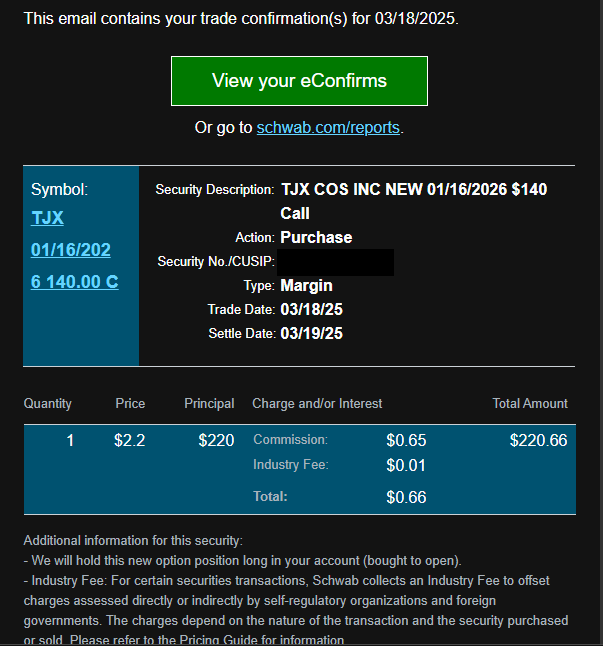

Second Round (The “Comeback” I Thought I Won)

Re-entered: $220.66

Sold: $666.32

Gain: +$445.66

So in my mind I’m like:

“Wow. I’m UP like $945.65. That’s growth. That’s evolution. That’s discipline.”

IRS: Actually...no.

Because your earlier loss of $279.33 gets rolled into this gain due to the wash sale.

So the real gain wasn’t $945.65.

Once the loss is applied back…

It’s more like $445.66 – $279.33 = $166.33

In other words:

I celebrated like I won the lottery…

When really I made like gas money.

Not premium gas either.

87 unleaded. 😭

Okay, Let’s Wrap Up the TJX Saga 😅

To not drag this TJX story into a Netflix Limited Series…

Yes.

I got back into TJX again.

But this time, I switched things up like a responsible adult with character development:

New Contract:

Expiration: 01/15/2027

Strike: $155

Entry: $356 (07/16/2025)

Exit: $545 (08/06/2025)

What I ended learning from this was:

- Wash sales are real — just because your screen is green doesn’t mean your taxes agree. (at least in the same play over and over)

- TJX moves slow — just not built like Tesla

- Trade the trend, not your lifestyle — loving HomeGoods doesn’t mean I needed to marry the chart.